[craft brewing industry report excerpt]

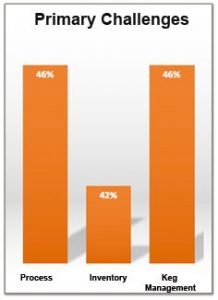

Primary Challenges Reported by Craft Breweries

Of the Primary Challenges reported, the respondents identified issues in three main areas: Inventory, Process, and Keg Management.

Inventory Challenges

Inventory Challenges are typically the result of volatile demand, annual supply contracts, and/or inventory process tracking.

Volatile demand is created because the market is favoring the new flavor and/or brewery. The small new guys are welcomed into the market quickly and soon ignored when a new beer appears in the market. The question ultimately becomes “how can a brewery become memorable, constantly innovative, and preferred by customers always thirsty for a new experience?” I believe one possible solution is being demonstrated by Mexican craft breweries. These beers continue to outperform their non-Mexican beer peers[1] because they have a solid following in the growing Hispanic market (a market predicted to grow by 167% by 2050). The ripple effect generated by the Hispanic market into the non-Hispanic market can clearly be seen and felt by a population purchasing more and more products that are Hispanic in origin.

Consumers are fickle and are enjoying a golden age of beer[2]. Experimentation is huge and we seem to be in an industry transition with how the consumer values beer. Consumers are increasingly valuing local and small breweries and with the majority of growth in the industry coming from these small breweries, there is an ample supply for consumers.

“…Instead of buying three kegs of a new beer and running through them all, as it might have done when local beers were a novelty, a bar tends to buy a keg and, once its empty, fill the draft line with a competitor’s product, and then another one, and so on…” Washington Post

If consumers are experimenting with brands and varieties of beer, then the traditional methods for forecasting sales become less reliable and the result is a volatile supply chain and inventory storage need. Some breweries handle this with additional storage and last minute supply ordering. This of course increases costs and erodes an already razor thin margin. Those breweries that are well capitalized are expanding into new markets while trying to maintain their hyper-small image.

This of course conflicts with the farmers of hops. These farmers are typically requiring annual contracts in advanced to support their business. The small brewer has a choice of paying a big markup for hops (thus reducing profits) or committing to a contract in advance while not really feeling confident in their sales forecasting.

We’ve put together a summary of tools that can help breweries with their forecasting (and more). For more suggestions please reach out to Gregory@dashbrew.com.

References

[1] “Why Mexican Beers Continue to Outperform the Industry” http://fortune.com/2015/12/30/mexican-beers-strong-sellers/

[2] “America now has more breweries than ever. . . .” https://www.washingtonpost.com/lifestyle/food/america-now-has-more-breweries-than-ever-and-that-might-be-a-problem/2016/01/15/d23e3800-b998-11e5-99f3-184bc379b12d_story.html

Recent Comments